From Capitol Hill, The Wall Street Journal reports that

Lawmakers worked Wednesday to reach an agreement on a short-term spending patch to avoid a potential partial government shutdown this weekend, with Democrats and Republicans still haggling over the details of the funding extension.

Party leaders had initially hoped to release an agreement earlier this week. Democrats have eyed a spending patch that would last until mid-or-late-January, while Republicans have pushed for a longer extension.

With just days until the government runs out of current funding at 12:01 a.m. on Saturday, Dec. 4, lawmakers will need to act quickly to pass the eventual agreement through the House and Senate. Meeting that tight timeline would require unanimous consent in the Senate to waive some of the chamber’s procedural hurdles, and any individual senator can slow down the process.

The article points out that Congressional leadership from both parties expects a continuing resolution to pass without a government shutdown. Of course we know from past experience that because the funding runs out on a Saturday, Congress has some additional time to complete work on the continuing resolution over the weekend if necessary.

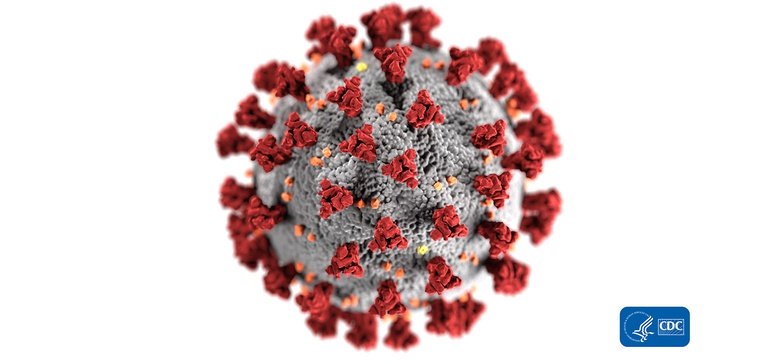

From the Delta variant front the Centers for Disease Control announced today that

The California and San Francisco Departments of Public Health have confirmed that a recent case of COVID-19 among an individual in California was caused by the Omicron variant (B.1.1.529). The individual was a traveler who returned from South Africa on November 22, 2021. The individual had mild symptoms that are improving, is self-quarantining and has been since testing positive. All close contacts have been contacted and have tested negative.

The FEHBlog senses that Delta variant is becoming jealous over the attention that the Omicron varian is receiving.

From the Delta variant vaccine mandate front, the Society for Human Resource Management tells us that

Consultancy Willis Towers Watson conducted a survey of large U.S. companies from Nov. 12-18 and asked if they currently require employees to be vaccinated against COVID-19 or plan to do so; 543 companies responded to the survey. Respondents indicated that they:

— Currently require vaccinations (18 percent).

— Will require vaccinations only if OSHA’s ETS takes effect (32 percent).

— Plan to mandate vaccinations regardless of the ETS status (7 percent).

Few employers (3 percent) with vaccination mandates have reported a spike in resignations, although nearly 1 in 3 (31 percent) of those planning mandates were very concerned that this could contribute to employees leaving their organizations. On the other hand, nearly half of employers (48 percent) believe vaccine mandates could help recruit and retain employees.

In addition to vaccine mandates, many large employers have taken or plan to take the following actions to protect employees who are returning to the workplace, saying that they will:

— Offer COVID-19 testing (84 percent), most on a weekly basis (80 percent).

— Require unvaccinated employees to pay for testing unless prohibited by state law (25 percent).

— Require or plan to require masks to be worn indoors (90 percent).

In hospital news, Healthcare Dive reports that

Hospitals saw operating margins continue to erode in October, declining 12% from September under the weight of rising labor costs, according to a national median of more than 900 health systems calculated by Kaufman Hall. It was the second consecutive monthly drop and comes as facilities are preparing for the fast-spreading omicron variant of the coronavirus.

Although expenses remained highly elevated, patient days and average length of stay fell for the first time in months in October, likely reflecting lower hospitalization rates as the pressure of treating large numbers of COVID cases began to ease, Kaufman Hall said in its latest report.

At the same time, operating room minutes rose 6.8% from September, pointing to renewed patient interest in elective procedures.

Fierce Healthcare adds that

Despite the threat of daily fines, hospitals have so far been slow to publish their prices online in accordance with a new federal regulation.

Radiology services look to be no exception, with new study data now suggesting roughly two-thirds of U.S. hospitals have not published commercial negotiated prices for at least one of the 13 radiology services designated as a common shoppable service by the Centers for Medicare & Medicaid Services (CMS). Hospitals are required to publish these prices in compliance with CMS’ Hospital Price Transparency final rule.

Further, the hospitals that did share their radiology service commercial negotiated prices appear to be all over the map, often setting price tags that varied by hundreds or thousands of dollars for certain imaging services.

The analysis—published in Radiology by Michigan State University and Johns Hopkins researchers—found than a mean 2,053 out of 5,700 hospitals (36%) had reported a price for one of these services as of Sept. 6.

From the telehealth front, Healthcare Dive informs us that

When U.S. patients envision their future medical care, the majority see telehealth playing a role. But when presented with the choice between an in-person or video visit for nonemergent care, most prefer a traditional in-office visit, according to new research analyzing consumer telehealth preferences.

The survey conducted by the nonprofit Rand Corporation published in JAMA on Wednesday found those who leaned toward in-person care were more willing to pay for their preferred visit modality, while those who preferred video visits were more sensitive to out-of-pocket costs.

Of the respondents who had used telehealth at least once since last March, only 2.3% said they were unwilling to use telehealth in the future, suggesting the method’s continued importance in hybrid models of care even after the pandemic — though it’s unlikely to be most patients’ first choice, researchers said.

In other news —

- Drug Channels offers its take on CVS Health’s recent announcement to right size its number of retail pharmacies (a roughly 10% reduction) and add even more healthcare focus to the remaining locations.

- Today “the Centers for Medicare & Medicaid Services (CMS) issued a Request for Information (RFI) to solicit stakeholder and public feedback that will be used to inform potential changes and future rulemaking to improve the organ transplantation system and seek to enhance the quality of life of those living with organ failure.”

- Becker’s Hospital Review discusses and provides interesting executive interview on how healthcare providers and health plans are seeking to improve and expand mental healthcare.

- This week’s Econtalk episode on our sense of hearing is outstanding. Check it out.