From Capitol Hill, Roll Call offers the House Speaker’s perspective on the debt ceiling negotiation, and the Washington Post does the same for the Senate Majority Leader. The FEHBlog is becoming more optimistic that the debt negotiations will be successful.

From the Omicron and siblings front, the FEHBlog was pleasantly surprised to see that his favorite Covid columnist David Leonhardt of the New York Times, has returned from his four-month long book leave. In his return column, he lists seven surprises that happened during his leave. Here is the Covid surprise.

A milder Covid winter. In each of the past two winters, the country endured a terrible surge of severe Covid illnesses, but not this winter.

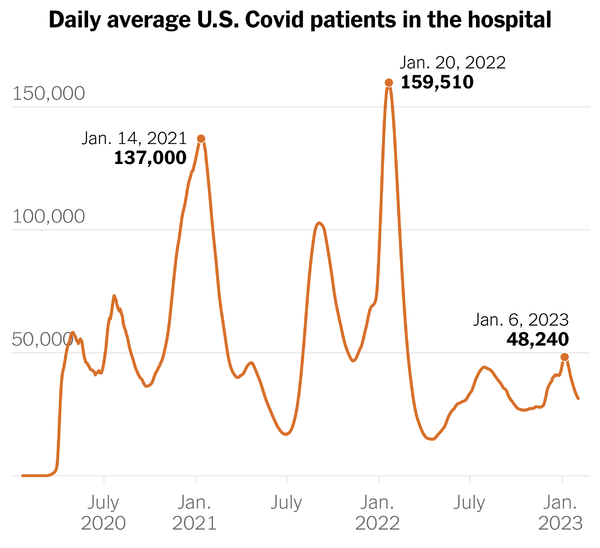

His column includes this chart of COVID hospitalizations.

Mr. Leonhardt explains —

It’s a sign that the virus has become endemic, with immunity from vaccinations and previous infections making the average Covid case less severe. If anything, the best-known Covid statistics on hospitalizations and deaths probably exaggerate its toll, because they count people who had incidental cases. Still, Covid is causing more damage than is necessary — both because many Americans remain unvaccinated and because Covid treatments are being underused, as German Lopez has explained.

Mr. Leonhart’s comment should come as no surprise to FEHBlog readers. Nevertheless, it’s encouraging to read it in the New York Times.

It’s worth noting that the first high peak from the left is Alpha which the Covid vaccines (released in December 2020) helped stem. The middle high point was Delta, and the highest point is Omicron which Paxlovid (released in December 2021) and other treatments helped stem. The public health authorities back in the day discussed a three-legged stool to deter Covid — one leg was immunity, the other was prevention (vaccines, etc.) and the third was treatments, which we did not broadly have until December 2021. What’s more the Omicron siblings have defeated some antiviral treatments but not Paxlovid.

On a related note of interest to care providers, CMS yesterday called attention to its regularly update Current Emergencies website which a chock-a-block full of helpful information.

From the Affordable Care Act and ERISA fronts

- Fierce Healthcare discusses provider and payer reactions to the ACA’s regulators’ recently closed request for public input on the apprpropriate scope of the ACA’s essential health benefits requirement.

- The Miller & Chevalier law firm discusses an important 9th Circuit U.S. Court of Appeals decision on remedies available in ERISA claim disputes. The decision favored the ERISA plans and their thir party administrators as well as the objective of health plan cost control.

From the executive personnel front —

- Fierce Healthcare invites us to meet Express Script’s new president Adam Kautzner.

- Healthcare Dive introduces us to CVS Health’s senior vice president and chief diversity, equity and inclusion officer Shari Slate.

From the broader U.S. healthcare business front —

The Wall Street Journal reports

CVS Health Corp. is close to an agreement to acquire Oak Street Health Inc.for about $10.5 billion including debt, a deal that would rapidly expand the big healthcare company’s footprint of primary-care doctors with a large network of senior-focused clinics, according to people with knowledge of the matter.

The companies are discussing a price of about $39 a share, the people said. The deal, if it goes through, could be announced as soon as this week, they said. CVS is scheduled to report earnings on Wednesday.

The Journal adds that “Oak Street, which has more than 160 centers across 21 states, focuses on the care of patients enrolled in Medicare” and that the deal would push CVS Health “far deeper” into direct provision of healthcare.

Beckers Payer Issues informs us

Alphabet, the parent company of Google, saw its medical stop-loss insurance business grow “nearly sixfold” last year, tech news site The Verge reported Feb. 2. The business, called Granular, provides medical stop-loss coverage to employers and is a subsidiary of Verily, Alphabet’s life sciences business.

Healthcare Dive tells us

- Looking at 2,000 U.S. hospitals’ websites, only about a quarter were in full compliance with federal price transparency rules, according to a new analysis from PatientRightsAdvocate.org.

- The majority of hospitals have some required files posted, but most are incomplete, illegible or do not clearly identify prices both associated with payer and plan, according to the report. Some 6% of the hospitals posted no usable pricing files.

- This latest report calls out both major for-profit and nonprofit chains across the country for not following the rules, including HCA Healthcare, Tenet, Providence and UPMC, which lacked any compliant hospitals.

From the Rx coverage / drug research front —

BioPharma Dive reports

- Gilead has secured an expanded U.S. approval for its breast cancer medicine Trodelvy, announcing Friday the Food and Drug Administration cleared the antibody treatment for the most commonly occurring form of the tumor type.

- Previously approved only for rarer, “triple-negative” breast tumors, Trodelvy can now be used to treat patients with metastatic breast cancer that’s hormone receptor, or HR, positive, but negative for a protein called HER2. This type of breast cancer accounts for an estimated 70% of all new cases, according to Gilead.

- The FDA’s decision is a win for Gilead, which gained Trodelvy when it paid $21 billion to acquire Immunomedics in 2020. But clinical trial results showed the drug’s benefit was modest, and Gilead will face competition from a rival drug sold by AstraZeneca and Daiichi.

The Raleigh NC News and Observer discusses a late stage breast cancer injectable drug that Duke University researchers have converted into an FDA approved pill. “[Duke researcher Donald] McDonnell expects elacestrant, which will be marketed as Orserdu, to completely replace the injectable treatment regimen. Not only is the pill less taxing for patients, clinical trials also found it to be more effective.”

STAT News reports

Japanese drugmaker Eisai reported Monday the first U.S. sales of Leqembi, its treatment for Alzheimer’s disease, although exact numbers were not provided and people taking the drug appear to be paying out of pocket because insurance coverage has not yet been established. * * *

The Food and Drug Administration approved Leqembi on Jan. 6. It costs $26,500 per year and is administered by infusion every two weeks. The drug has the potential to be a commercial blockbuster, but only if Medicare can be convinced to pay for it. Unless Medicare changes the way it pays for drugs like Leqembi, Eisai expects a slow commercial rollout.

“Engagements with payers is steadily ongoing towards insurance coverage,” Eisai said Monday, although no new details about its communications with Medicare were provided. “Several” private insurers were “advancing their formulary discussions” about Leqembi reimbursement, Eisai also said, although specific coverage decisions, if any, were not disclosed Monday.